One of DTC eCommerce darlings with over $1B USD valuation Casper filed for IPO. Aside of speculations will it be a good deal for retail investors and what are the chances of Casper to succeed long term, looking into SEC filing documents provides some interesting insight of the significant Direct To Consumer brand economics. This post isn’t analysis of viability of Casper as a business, but rather what lessons can ecommerce entrepreneurs and managers can learn from the data available.

DTC eCommerce is hard

I am always laugh when here self-proclaimed gurus who talk that it has never been better time to start eCommerce business. Just sign-up for $19.99 per month to one of SaaS platform, purchase our secret sauce ebook and you will become rich/leave your boring day job in few weeks if not overnight.

While it is true that setting up a simple online store is now easier than 15 years ago thanks to SaaS platforms like BigCommerce of Shopify, other parts of businesses are getting harder.

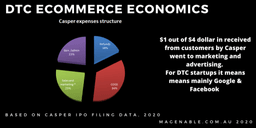

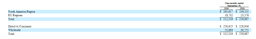

Let’s look into Casper Profit/Loss statements for 2017-2018 and for first 9 months of 2018-2019

Here are 3 the most important things:

- The company is still not profitable and burning investors money, after 5 years of operation and significant scale

- Returns takes almost 20% of total sales

- Advertising and marketing (hello Google tax) takes another 25% of total sales or 1/3 of sales after returns and discounts

Per one average retail order it looks like in the table below:

| Casper P&L | In M $USD | % | Per order |

| Revenue | $ 392.0 | 100% | $ 710.00 |

| Refunds | $ 80.0 | 20% | $ 144.90 |

| COGS | $ 157.0 | 40% | $ 284.36 |

| Gross Profit | $ 155.0 | 40% | $ 280.74 |

| Sales and marketing * | $ 114.0 | 29% | $ 206.48 |

| Gen. /admin | $ 106.0 | 27% | $ 191.99 |

| Total operational exp. | $ 220.0 | 56% | $ 398.47 |

| Losses | -$ 65.0 | -17% | -$ 117.73 |

Back to previous point of the best time to start ecommerce business. It may be easier to start and the technology is less costly now, but advertising is expensive and the competition is fierce.

Return customers

“Hold on”, say some gurus, “It is expensive to acquire a customer first time, but then we keep her and cover our acquisition costs plus get some profit”.

Let’s see how does it work for Casper so far.

Company states that (extracts from SEC filing):

- 20% of customers in our direct-to-consumer channel during the first nine months of 2019 were repeat customers;

- Across our retail channel, our AOV increased from $437 in 2017 to $720 in 2018 and to $820 for the nine months ended September 30, 2019; note that across all channels AOV was $710 in 9 months of 2019

- Retail channels revenue was $258M in first 9 months of 2019

- We are building a universal, enduring brand that is already embraced by over 1.4 million happy customers

Simple calculation (assuming that customer buys not more often than once per year, which is a reasonable assumption for mattresses) gives us that that sales was from 315,396 customers .

20% of them were return customers it is equal to a bit over 63,000 or 84,000 per year if we linearly extrapolate 9 months to full year.

It is 6% out of 1,400, 000 of all customers, so each year just 6 out of 100 customers come back to Casper. Not very surprising numbers for mattresses, which expect to serve 10 years, but not very good for a business that relies on repeat customers to recover exuberant initial acquisition costs.

Customer Live Time Value (LTV)

Projecting that data to LTV (taking life to 10 years) we get close to half of customers should repurchase from Casper in 10 years and customer LTV of around $1,200.

It is much better than $820 (with just one purchase per customer). But the company exists over 5 years, so already getting repeat customer and still have huge acquisition costs referred above. So it is a big question, what happens when Casper starts to spend less on advertising and marketing.

From the data available it is also not clear what repeat customers purchase. If it is a pillow after a mattress – surely better than nothing, but probably not get enough to save the business.

More on advertising costs

In this section I’ll calculate how much Caper may paid for advertising per one transaction.

As we know for average order (across all channel) of $710, $206 was spend on marketing and advertising.

I couldn’t find public information about Casper website conversion rate, but there are estimations that for this industry it should be between 0.9% and 1.6%

It brings us average cost per visit (which is close to cost per click) of $1.86 to $3.30.

For paid advertisement that numbers are probably much higher if organic and direct visits subtracted. So we are probably talking about $4-$10 per click and even more for competitive keywords.

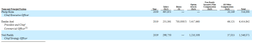

Executives compensation

Another interesting piece of information is how much executives of such business earn. SEC filing contains that information.

Out of 3 executives listed 2 (Neil Parikh and Philip Krim) are founders. While Casper is not profitable, both of them are paid decent money even just cash component. So from founders prospective even if Casper IPO fails and the company flops completely, all is probably not too bad. They were paid rather well along the journey and got back $100,000 of credit card debts they took in early business days.

Content marketing risks

Casper IPO filing risk section contains the next very common risk

use of social media and influencers may materially and adversely affect our reputation or subject us to fines or other penalties.

and in more details

In addition, the number of third-party providers of consumer product reviews, consumer recommendations, and referrals is growing across industries and may influence consumers. Negative or no reviews from such third parties may receive widespread attention from consumers, which could damage our reputation and brand value and result in lower sales.

Content marketing, reviews and influencers is popular now and helps businesses to mitigate raising costs of more traditional digital channels like SEO and PPC. But it comes with cost and risks, which can’t be ignored.

Summary of the lessons learned

- DTC ecommerce is hard – marketing, returns and other expense eat up margin even for business of significant scale

- Return customers may not be your silver bullet in many industries and business models

- Alternative forms of marketing (reviews, influencers, content marketing) bring their own risks

- As a founder if you survive first years and scale business well, you can be quite well financially even with not profitable venture

If you need support from business and technology experts in your not easy ecommerce journey – don’t hesitate to contact us. Initial consultation is free.