In this post we’ll provide short intro of what is Buy Now Pay Later in relation to eCommerce and review the solutions available for Australian online retailers – Afterpay and zipPay.

What is Buy Now Pay Later in eCommerce space?

Buy Now Pay Later – how it works

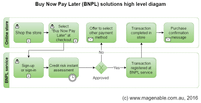

As you may guess from the name Buy Now Pay Later solutions allow customer to get product now with delayed payment. The diagram below illustrates the concept.

- Customer shops the online store as usual, placing products to the shopping cart

- At the checkout she can select Buy Now Pay Later (referred as BNPL at the diagram) service

- She’ll forwarded to BNPL service website, where she signs-up (new customer) or signs-in (existing customer)

- Buy Now Pay Later service assesses credit risk of the customer and either approves or rejects the financing for this purchase

- If approved Customer is forwarded back to online store where the transaction is registered and sees thank you message

- If rejected she can use other payment methods to complete the purchase

We’ll limit this research to the services integrated with online stores the way above and don’t review such solutions as virtual credit cards that probably solve the similar problem, but in a bit different way.

[sociallocker id=”2608″]

Benefits for customers

- Possibility to get product even if there is not enough cash and credit card can’t be used for various reason

- Typically zero or pretty low cost for short time financing (if paid in time)

- Simple sign-up and almost instant assessment (much simpler and quicker than getting credit cart)

Benefits for merchants

- Increased conversion

- Increased average transaction value

- Comparatively easy integration

Costs for merchant

Access to the benefits has costs: for use of Buy Now Pay Later solutions merchants pay transaction fees, typically higher than with more traditional payment methods (credit/debit cards, Paypal). The cost varies depends on the provider and we’ll review the solutions available in Australia.

Cost for customers

While it is zero or low cost for customers if they pay their debt to BNPL services in time, late payments or payment extension over grace, free period will incur additional fees.

Buy Now Pay Later options for Australian online merchants

Afterpay

Afterpay (www.afterpay.com.au) started the business in 2015 and this year got listed at ASX. According the last available information it serves over 160 merchants and 60,000 consumers.

For consumers Afterpay offers interest and commission free financing for the period of 6 to 8 weeks. The purchase cost is split to 4 equal instalments paid every 2 weeks (for new customers first instalment is due at the time of purchase, for existing – after 2 weeks). Late fees are applied for the consumers who don’t pay in schedule.

Afterpay checkout screenshots

-

![]()

- Afterpay – shopping cart

-

![]()

- Afterpay – payment selection

-

![]()

- Afterpay sign-in

-

![]()

- Afterpay payment

Merchants pays commission of 4-6 percent plus 30 cents per transaction for the payments conducted through Afterpay. The due money are transferred to merchant bank account within 48 hours. Afterpay assumes consumer credit and fraud risk.

There are out of the box integrations available for several popular eCommerce platforms – Magento, WooCommerce, Shopify and Neto and API for custom integration.

Some merchants that use Afterpay: Tony Bianco, General Pants, Aquila, House, Adore Beauty

zipPay

zipPay (zippay.com.au) is a new solution from another ASX listed business – zipMoney Limited. According the recent company announcement there are 40 merchants using zipPay and the number is growing. Important to note that zipPay is just one product of zipMoney, which also offers other solutions. The significant difference from competitors is that zipMoney has Australian Credit Licence, so can offer financing to consumers.

To pay with zipPay consumer needs to set an account with zipMoney, which is a kind of digital wallet, similar concept with Paypal. The core different that with zipMoney consumer has a line of credit and that line of credit can be used to pay online where zipPay payment method is allowed. zipPay credit is free for consumer for the period of 60 days. Thereafter it costs $5 per month, which is charged as account support fee. Important to note that consumers need to use Facebook or Paypal account to sign-up with zipPay, which sometimes may be an additional barrier. As you see below with Facebook the customer is asked to provide substantial set of permissions; probably the information is used to assess credit risk.

zipPay checkout screenshots

-

![]()

- zipPay checkout

-

![]()

- Payment with zipPay initial screen

-

![]()

- Sign-in or sign-up

-

![]()

- Facebook sign-up permissions

For the merchants zipPay commission is in range of 1-4% depends on the volume of transactions plus 15 cents per transactions. Settlement is done on daily basis at 4 pm.

There are out of the box integrations with Magento, WooCommerce, Shopify, Neto and Shopp and API for custom integrations.

Merchants that use zipPay include Co-op, Antoine and Stanley and Sporting House Direct.

Touch Payments

Touch Payments is the last solution we planned to review and the only private company in our research, so the information here is a bit more limited. According official (Australian Business Registry) records, business name Touch Payments belongs to CHECK’NPAY FINANCE PTY LTD, which was registered in 2013 in NSW.

Touch Payments approaches consumers from a little bit different angle, the main motivation for them to use this payment method is “Try before buy”. The company offers 16 days ‘evaluation’ period for the products purchased through the system. After the end of this period a consumer needs to decide: to pay or to return the product to the merchant. The payment can be done via credit/debit cards, BPAY, bank transfer and cash in post office.

The cost for merchant is 1.5-3% plus 30 cents per transaction. There are out of the box integrations available for Magento, WooCommerce and Zencart and API for custom integration.

At the company website there are number of merchants who uses the system listed, including Showpo and Neverlandstore, but when we checked them we couldn’t find Touch Payment as a payment method available.

N.B. When we tried to contact Touch Payments through email and the phone to get additional information about their solution, all our attempts were not successful – nobody answered the phone and email.

Combined with the fact of the absence of the Touch Payments on all referred merchant websites we checked, there is high possibility that the business doesn’t operate any more. We’ll be happy if it is wrong and there is just a temporary disruption though, so the comments from Touch Payments representatives are welcomed.

What Buy Now Pay Later solution to select?

The table below provides head-to-head comparison between Afterpay and zipPay. Taking into account that there is high probability that Touch Payments is not operating any more we decided to exclude it from the final comparison.

| Afterpay | zipPay | |

|---|---|---|

| Costs for consumer | Free if no late payment | Free for 60 days , $5 per month thereafter |

| Financing period | 6-8 weeks | No hard limit, min $30 per month repayment |

| Limits | $1,200 shopping cart size | $1000 credit line (consumer) |

| Cost for merchant | 4-6% plus 30 cents per transaction | 1-4% plus 15 cents per transaction |

| Integrations | Magento, WooCommerce, Shopify, Neto | Magento, WooCommerce, Shopify, Neto, Shopp |

| API | + | + |

| Ease of checkout | 5 out of 5 | 4 out of 5 |

Magenable recommendation

With longer term financing available zipPay may be a right choice in the cases when it is important. It also costs less to merchants.

Afterpay in our opinion provides better user experience, the checkout is a bit simpler: the process is shorter, less information required and you don’t have to have Facebook or Paypal account to sign-in.

Taking into account comparative ease of integration and limited number of options available it probably even makes sense to experiment and try both options, especially if you run store on one of the platforms that support out of the box integration like Magento eCommerce.

Update: there is a new service Openpay appeared on the market, you can read about it in our blog post.

[/sociallocker]

Disclaimer

Information presented in the article is connected from public sources and provided by vendors. While we did our best to present it in accurate, there is still a chance of mistakes; also note that the market moves fast and the information can be outdated. No claim is made as to the accuracy or authenticity of the content of this web page. Magenable does not accept any liability to any person for the information or advice (or the use of such information or advice) which is provided on this web page.