Gartner recently published their new Magic Quadrant for Digital Commerce. In this post we’ll write about what changed comparing with Magic Quadrant 2014 and specifically where is Magento Enterprise in this research.

Market outlook and trends

Business leaders have high expectations toward ecommerce and digital business in general. A survey conducted by Gartner among CEOs last year found that the percentage of revenue mostly attributable to digital/e-commerce in organizations is expected to be 41% by 2019, comparing with 31% expected in 2016. In line with that investments in digital commerce initiatives continue to increase, spending on digital commerce platforms in 2015 was $4.7B, 15% more than in 2014.

Other interesting forecasts:

- Ecommerce is getting more and more complex – by 2018 more than 50% of online stores will integrate technologies from over 15 vendors to deliver digital customer experience.

- Smart personalisation will increase digital businesses profit by 15%

- 40% of B2B commerce websites will use price optimisation algorithms and configure/price/quote mechanisms

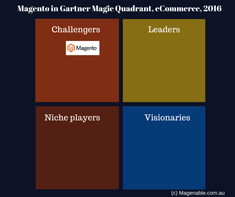

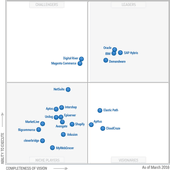

Magento Enterpise stays in Challengers

Gartner analysts keep Magento Enterprise in Challengers Quadrant. In Gartner’s methodology challengers have high ability to execute, but lower completeness in vision.

Magento strengths are:

- Extensive ecosystem with 70,000 developers and over 8,000 extensions. Gartner noted success in Magento certification programs that allows to make merchant’s experience with developers more consistant

- Cost-effectiveness. We wrote change in Magento Enterprise pricing for Magento 2, but still Magento provides very good value for money and TCO (total cost of ownership) is lower than major competitor’s

- Split of eBay and work as independent business makes the company more focused

Among caution points Gartner refers to problems that merchants will face in migration from Magento 1 to Magento 2 and lack of out-of-the-box functionality for B2B commerce (while there are extensions on the market to provide it).

Garner Magic Quadrant for eCommerce 2016. Source: Gartner, March 2016

Other interesting changes comparing with 2014

- Demandware moves up from Challengers to Leaders to join IBM, Oracle and SAP/Hybris that keep their position

- Elastic Path, Apptus and CloudCraze appears in previously empty Visionaries quadrant

- Digital River stays in Challengers, there are only 2 platforms there (Digital River and Magento)

- Popular SaaS SMB solutions such as BigCommerce and Shopify that tries to extend to enterprise market appeared in Niche Player quadrant

References

- Magento in Gartner Magic Quadrant 2014 (our blog)

- Garner Magic Quadrant official announcement

Update

Magento in Gartner Magic Quadrant 2017 (out blog)